Today, the IRS announced inflation adjustments for various provisions of the Tax Code that will take effect for 2024. The IRS makes inflationary adjustments annually.

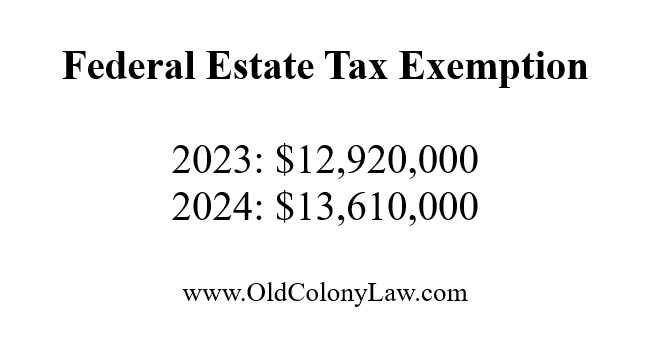

Among the provisions impacted is the Federal Estate Tax Exemption. The 2023 Federal Estate Tax Exemption is $12,920,000. In 2024, the Federal Estate Tax Exemption will increase by $690,000 to $13,610,000.

With a Federal Estate Tax Exemption this high, many families do not have to worry about their inheritances being eroded by a surprise Death Tax. However, federal tax law is set to undergo dramatic changes unless Congress passes a new tax law before the end of 2025. That is because the so-called Tax Cuts and Jobs Act, passed by Congress in 2017, and which included a significant increase to the Federal Estate Tax Exemption, will sunset.

In other words, Congress did not make the rather favorable 2017 change to the Tax Code permanent. As a result, families who may not be expecting to have a federally taxable estate now may have an estate subject to significant taxes in about three years time.

Therefore, while the Federal Estate Tax may not be a concern for those individuals with smaller estates at this particular moment in time, careful estate tax planning can help ensure that estate plans are positioned to minimize estate taxes and adapt to changing estate tax laws. You are welcome to schedule a brief call with us to talk about whether your estate plan may need to be updated in order to have the most favorable tax outcome.

You can view the full IRS release here.