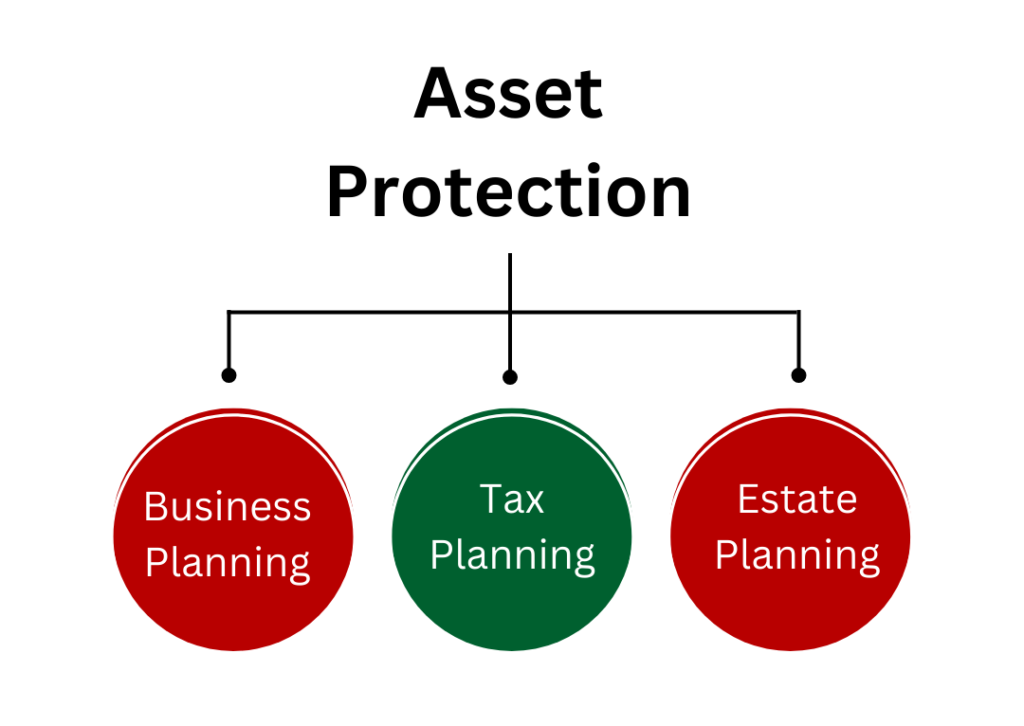

Asset protection planning involves making prudent decisions today to protect yourself, your family, your business and your hard-earned assets from loss due to lawsuits, creditors, the government or bankruptcies.

Asset protection planning is especially prudent for professionals, business owners and public figures whose personal assets could be at risk due the nature of their employment or professional endeavors.

Why Engage in Asset Protection Planning

Statistically and anecdotally, we all know that the number of divorces, bankruptcies and lawsuits (not to mention the amounts of verdicts!) is staggering. The reality is it just takes a single lawsuit or mistake or stroke of bad luck to completely wipe you out financially.

At the same time, it can seem like either these concerns are overstated or that your particular risk of such financial or legal disaster is fairly remote.

While fears of litigation can be exaggerated, taking protective steps now can (1) be cost effective, (2) be accomplished fairly quickly, and (3) help you sleep at night. In addition, Asset Protection planning now can also prevent litigation from happening in the first place and strengthen protection in a worst-case scenario.

We help business owners limit their liability, keep their companies in compliance with the law, and plan for the future with customized estate planning and business legal counsel.

Asset Protection Strategies

Asset protection should not require you to engage in tax evasion schemes, fund offshore accounts, engage in financial experiments or research the viability of an Internet gimmick.

It would not make sense to engage in such unlawful, unethical, unproven or uncertain tactics when there are perfectly reliable ways to leverage the law and deploy other tools to protect yourself.

Estate Planning

No matter who you are or your tax situation, you need to have an estate plan. Having an estate plan in place and calibrated to your particular tax situation and personal wishes ensures that you (and not the Commonwealth) decide how your assets are distributed at your death.

Estate planning can also help establish a structure for managing your assets during your lifetime. For example, it is common for families in Massachusetts to establish trusts to protect a home, preserve privacy or manage the transition of a family business.

Limiting Liability for Professionals & Business Owners

Many entrepreneurs operate their businesses as sole proprietors rather than through a legal entity, such as a corporation or Limited Liability Company. While these business owners are attracted by the informality of sole proprietorship and do not want to incur legal fees to create and maintain a legal entity, conducting business through a legal entity may offer substantial risk management benefits.

Lawsuits brought against a sole proprietorship are really lawsuits against the owner’s personal assets. Likewise, lawsuits against a properly created and maintained legal entity are really lawsuits against the entity’s assets.

“In an increasingly litigious world, business owners are concerned about protecting their personal assets from claims by customers, vendors, employees, competitors and other creditors. They are also concerned about overzealous government regulators, natural disasters, criminal activity and other potentially costly business disruptions.”

Ben Palkowski, Attorney, CPA and Co-Owner of Old Colony Law

Non-Legal Asset Protection Strategies

In addition to establishing any trust or business structures that may be advisable, Asset Protection will likely involve some element of non-legal planning. A perfect example of an Asset Protection tool all have in one form or another is insurance. Indeed, the fundamental concept of insurance coverage is to pay a premium you can afford to transfer a risk you cannot afford. Data security, lifestyle choices and business practices are other factors that can impact liability exposure.